The interest rate has reached a level of 4.75% annually, with a tenth increase within a year.

Against a backdrop of numerous criticisms, the Monetary Committee decided yesterday (Monday) to raise the interest rate by an additional 0.25%, bringing it to 4.75% per year. In addition, a plan was revealed to increase the prime rate (the base interest rate) to a rate of 6.25% per year. This marks the tenth consecutive increase since April 2022.

The decision to raise the interest rate was made in response to forecasts of inflation and rising prices among the public. In April, inflation reached a rate of 5% per year, and Israeli economic indicators also indicate economic strength, with an unemployment rate dropping to 3.6%.

The expectations of high inflation and the strong sources of the economy have raised concerns about further price hikes. According to Dr. Ron Tomer, President of the Manufacturers Association and Chairman of the Employers and Business Association, the government should reconsider the decision to raise the interest rate and actively deal with the high cost of living in the country. Tomer argues that the cost of living and conducting business in Israel has reached unprecedented levels.

The tenth consecutive increase in interest rates may lead to proactive measures by the government to reduce the inflationary cycle and maintain economic stability. Industrial and labor organizations are urging the government to support price stability by lowering prices in cases such as property taxes, electricity, and water.

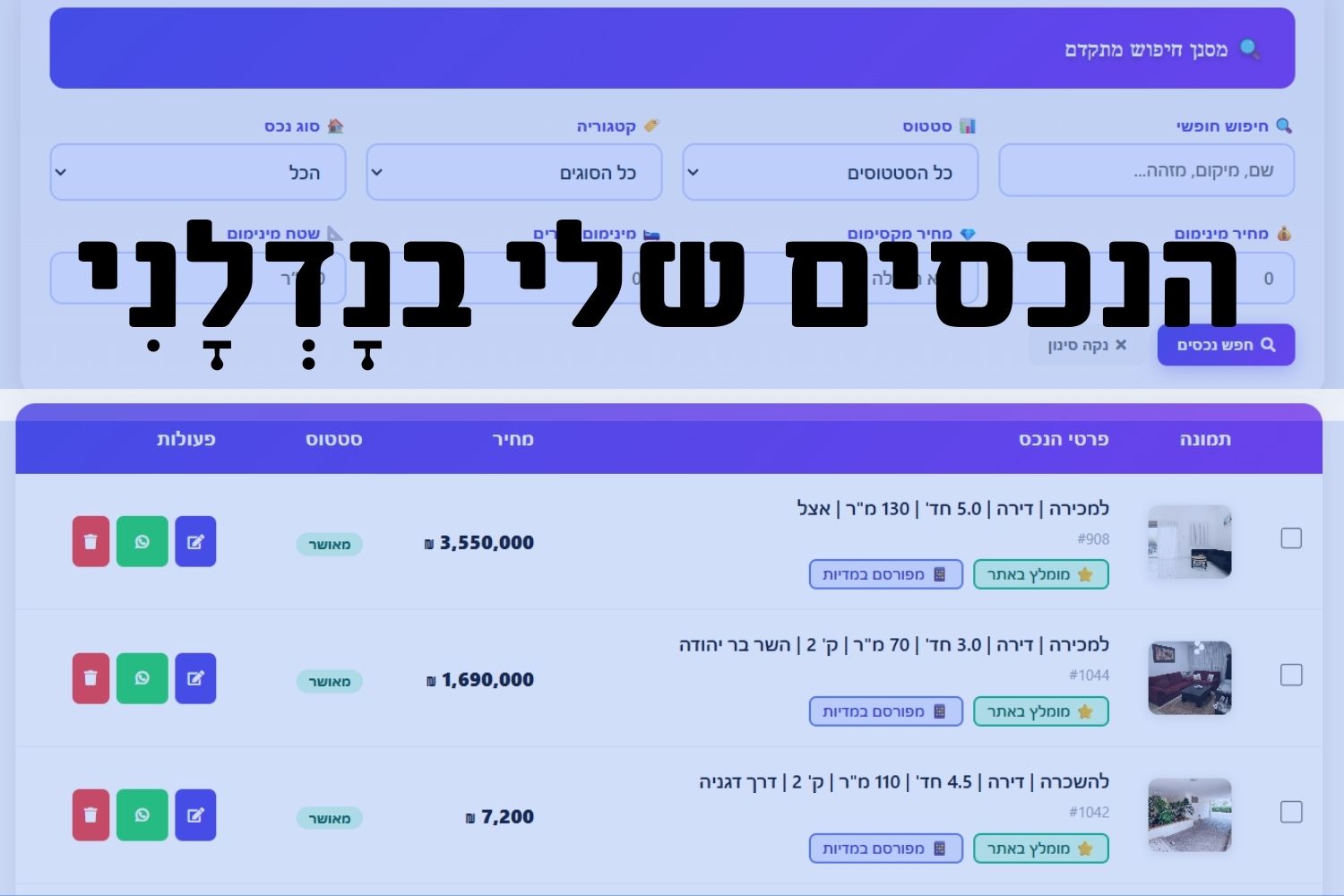

Price stability will be the correct step to prevent small businesses collapse. However, the more correct approach would be to release land for construction anywhere possible in the country, rather than resorting to other short-term measures such as raising interest rates, which will help lower housing prices in Israel (according to a real estate website opinion).

Dr. Ron Tomer, President of the Manufacturers Association and Chairman of the Employers and Business Association, argues that the prolonged increase in interest rates affects the cost of living and business activities, and suggests that the government take active steps to reduce the burdens it imposes. Tomer claims that the Israeli government is the most monopolistic, leading to a high cost of living and business costs compared to other countries. According to him, the government should contribute to the joint effort and take adequate steps to lower price levels in the economy by reducing inflation.